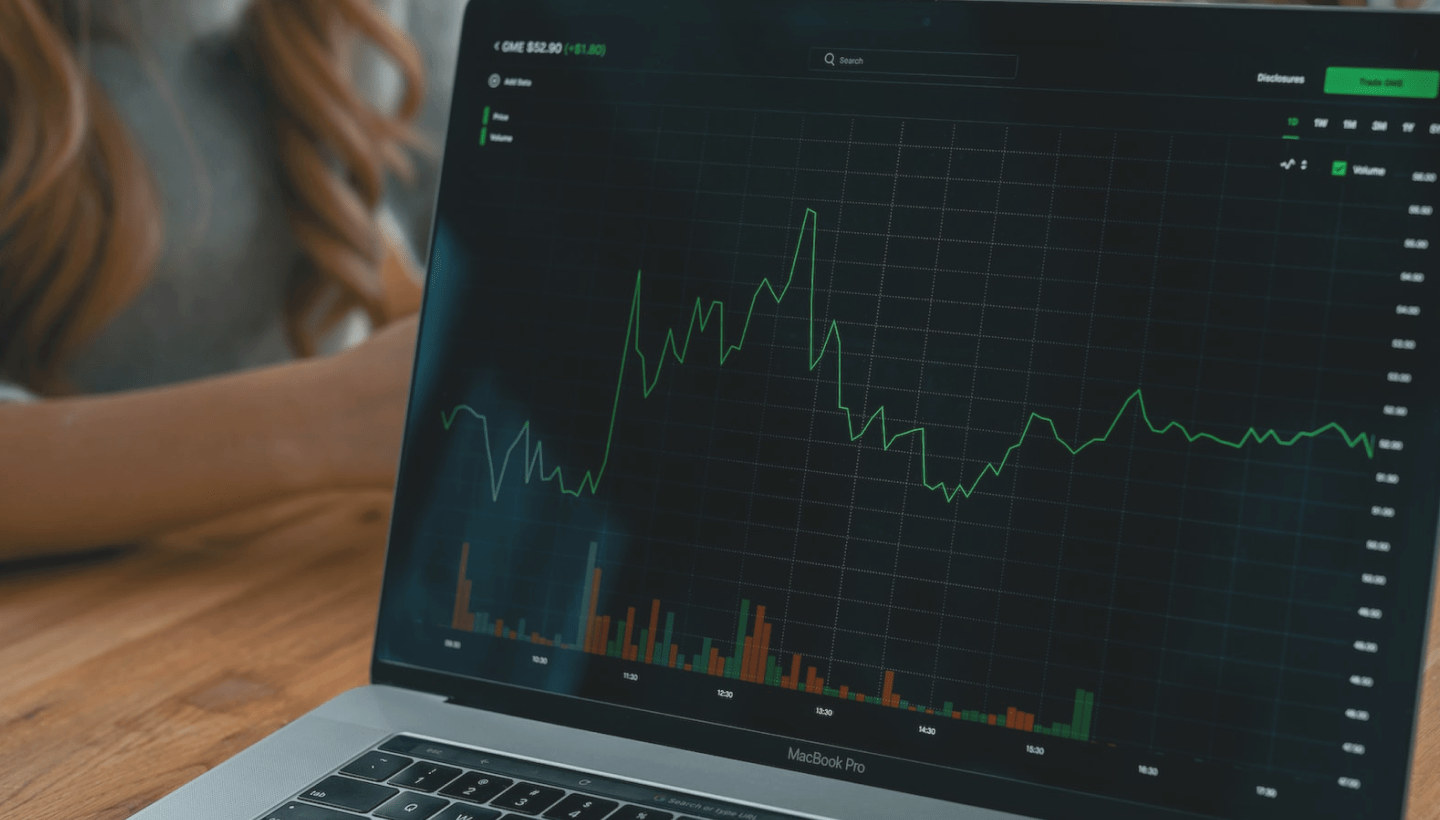

How We Bagged a 134% Gain in Our Latest Options Trade –And You Can Too

We don’t just throw darts at a board and hope for the best. Our approach to stock picking and options trading is a well-oiled machine built on decades of institutional experience....

Nike Sprints To Become E-Tail Powerhouse

To learn how to improve your results in the market dramatically by buying options on stocks like Ford and Tesla, take a two-week trial to my special service, Tactical Options:...

Initial Coin Offerings Mint Danger

To learn how to improve your results in the market dramatically by buying options on stocks like Ford and Tesla, take a two-week trial to my special service, Tactical...

How To Play It: Mobility

To learn how to improve your results in the market dramatically by buying options on stocks like Ford and Tesla, take a two-week trial to my special service, Tactical...

Spy On Accenture And Palantir For Cybersecurity Leadership

To learn how to improve your results in the market dramatically by buying options on stocks like Ford and Tesla, take a two-week trial to my special service, Tactical Options:...

Electric Dreams Fuel Major Upgrade For Ford Shares

To learn how to improve your results in the market dramatically by buying options on stocks like Ford and Tesla, take a two-week trial to my special service, Tactical Options:...

Cashing in on Clinton-Trump agreement

Hillary Clinton and Donald Trump actually agree on something. And it’s likely to lead to a bonanza for the economy and investors. About dam time. In early August, both the Clinton...

Apple’s Blowout Earnings Prove Its Shares Are Cheap

To learn how to improve your results in the market dramatically by buying options on stocks like Ford and Tesla, take a two-week trial to my special service, Tactical Options:...

Spike In Cyberterrorism Opens The Door For CrowdStrike

To learn how to improve your results in the market dramatically by buying options on stocks like Ford and Tesla, take a two-week trial to my special service, Tactical Options:...

The Machines That Build Machines, Porsche Vs Tesla

To learn how to improve your results in the market dramatically by buying options on stocks like Ford and Tesla, take a two-week trial to my special service, Tactical Options:...