Epic professional bond selling is near term bullish, really

I ran across some fascinating research by Jason Goepfert of Sundial Capital. He observes that TLT -- the popular bond ETF that tracks Treasurys with maturities of 20 years and longer -- has seen epic outflows of late.

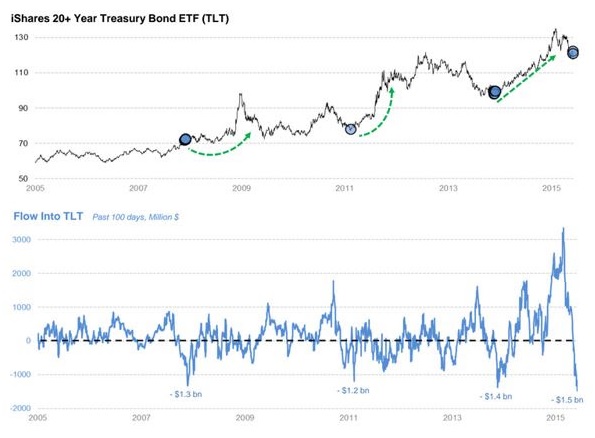

The bottom chart above shows the fund flows for TLT over the past 100 days, and it has dropped to a new record low of -$1.3b billion. Other times that the flow exceeded -$1.2 billion over the past 100 days are circles on the top chart above. Each time it led to a long-term rally in the TLT as bonds rebounded.

Of course, Goepfert acknowledges, bonds have been in a multi-decade bull market, so bouts of extreme pessimism have been great buy points. And at some point that will stop and pessimism will lead to nothing but more losses. Yet at this point the outflow is about 33% of total assets, which is the equivalent of other extremes marked on the chart.

Goepfert goes on to say that other bond sentiment measures he tracks are neutral on the long-term US bonds, rather than overly pessimistic, so he's not turning positive on a medium- or long-term basis. But for a short-term trade, he argues that this bout of extreme pessimism is worth at least a rebound of decent sized proportions. That's a valuable insight.

-- Jon D. Markman

**

-- Sign up for a free trial to Strategic Advantage to see ideas like this every day.

-- Sign up for a free weekly Change Log report on the ways technology is changing business, health care and culture.